Over the last year, we’ve seen the risk of recession decline, rising interest rates, an ever-fluctuating stock market, and an unemployment rate that remained relatively steady at historical lows. The U.S. September and October jobs report fluctuated significantly, further muddying the outlook. So where does the labor market currently stand?

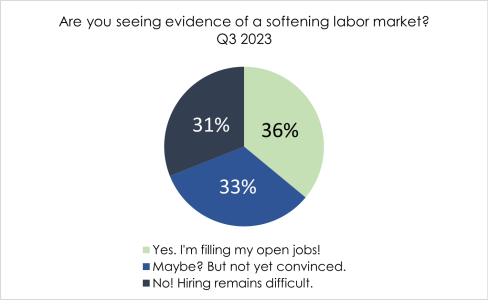

In our capacity as a research-centric organization we polled hiring managers across the country with a direct question, “Are you seeing evidence of a softening labor market?” gathering data quarterly, over the last year. In Q3, our data suggest that the labor market is softening. As summarized in Figure 1, results indicate that hiring managers remain evenly split in their perspectives of the labor market, but with a definitive edge to those reporting “Yes, I’m filling my open jobs.” Combining the “Maybes” we’re seeing more than two-thirds reporting evidence of a softening labor market.

Analyzing the data by industry largely represents the greater distribution with two standouts. Healthcare continues to report a difficult hiring market, while those in the insurance industry reported the highest response of “No! Hiring remains difficult.” Additionally, senior-level managers reported more difficulty hiring. The unique dynamics within specific industries are the most reasonable explanation, while difficulty recruiting mid-level and senior candidates may be a leading indicator of risk-off decisions by more established leaders.

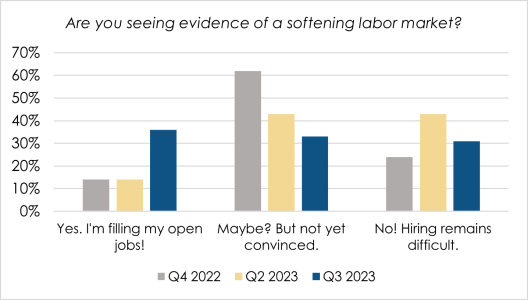

Shifting to trend analysis, the quarter-over-quarter data as represented in Figure 2, suggests that respondents became less doubtful and more convinced, with those in the “Maybe? But not yet convinced” halving from 62% to 33%, in less than a year. This is evident in the notable shift in the percentage of respondents successfully filling their open positions. This number has risen from a modest 14% in Q4 of 2022 to an encouraging 36%.

Our analysis validates a changing labor market and provides insight not always obvious from the official statistical reports. While uncertainty is undeniable, it also highlights opportunities for innovative solutions and strategies. Leading organizations should continue to understand the Voice of the Employee and strategically manage human capital with a long-term perspective and appropriate operational changes. This approach starts with understanding your current employees—who they are and what they need to remain happy, engaged, and fulfilled. Attadale partners with companies to gather employee feedback and offer valuable insights that empower executives to make informed decisions concerning their recruitment and retention strategies.

If you’d like more information on how to quickly gather employee-voice insights so you can increase retention and attract top talent, please contact us via attadalepartners.com/ or book a 30-minute conversation with our Managing Partner, Geoff Colgan here.

Additionally, if you would like to stay updated with our upcoming Q4 labor poll or partake as a respondent, please sign up here. Don’t forget to like and follow us on LinkedIn and Twitter for the latest news, notes, and insights on all things AI, analytics, and market research.

Q3 2023 survey responses collected between September 25 and October 9, N=4,169.